Introduction to USD to AUD Conversion

In a world driven by global commerce and international connectivity, understanding currency exchange—specifically from dolar americano a dolar australiano—is essential for businesses, investors, and even travelers. As we enter 2025, the relationship between the US dollar (USD) and Australian dollar (AUD) holds significant weight across multiple sectors including trade, tourism, commodities, and finance.

Why is this specific currency pair gaining attention? The USD, as the world’s primary reserve currency, commands international financial influence. Meanwhile, the AUD, heavily tied to resource exports like iron ore and coal, reacts dynamically to global market shifts. Together, their interplay reveals much about global economics and investment strategies.

Over the last decade, these currencies have fluctuated amid geopolitical tensions, pandemic recovery, climate policy transitions, and shifting interest rates. Each of these elements paints a broader picture of how money moves between nations, and more importantly, how individuals and corporations can leverage these shifts to their advantage.

In 2025, new challenges and opportunities emerge: rising green energy investments, inflationary pressures, and digital finance technologies are all playing a role in shaping the future of the USD to AUD exchange rate. This article dives deep into every angle you need to understand the currency landscape, offering real-world data, expert analysis, and practical advice.

Whether you’re an investor hedging against currency risk, a student planning to study abroad, or simply someone curious about forex trends, this comprehensive guide will equip you with everything you need to navigate the dolar americano a dolar australiano exchange in a changing global economy.

Current Exchange Rate Overview

The exchange rate between the US dollar and the Australian dollar is influenced by a web of global and domestic factors. As of mid-2025, the average rate hovers around 1 USD = 1.52 AUD, though day-to-day fluctuations are common. This real-time value serves as a barometer of both nations’ economic health and investor sentiment.

This rate doesn’t exist in a vacuum. It’s continuously shaped by central bank policies, commodity prices, inflation expectations, and geopolitical developments. Currency traders watch it like hawks, anticipating profits or risks from micro changes. Even small shifts—say from 1.50 to 1.55—can mean significant gains or losses in large transactions.

For everyday consumers or businesses, the current rate matters for budgeting, purchasing, and pricing. For instance, a US-based eCommerce seller who exports to Australia must constantly adjust product pricing based on the strength or weakness of either currency. Likewise, an Australian company sourcing raw materials from the US might postpone orders if the AUD weakens.

Additionally, global financial institutions update their foreign exchange forecasts regularly. As of now, most anticipate mild volatility for the rest of 2025, with some analysts predicting a potential strengthening of the AUD if commodity exports increase and inflation remains under control.

With currencies this closely watched, even a single policy speech or employment report can trigger a spike or drop. That’s why staying updated with real-time data and economic indicators is crucial for anyone with skin in the forex game.

Historical Trends Between USD and AUD

The relationship between the US dollar and Australian dollar has seen highs and lows, reflecting the economic tides of each nation. In the early 2000s, AUD traded near 0.50 against the USD, showcasing its relatively weaker position. However, during the commodities boom of 2011, AUD surged above parity, hitting 1.10—a rare occurrence that signaled strong Australian exports and global demand for raw materials.

That wasn’t to last. As China’s growth slowed and global commodity prices dipped, the AUD slipped back below the USD by mid-2014. The pandemic era brought fresh volatility, with AUD hitting lows near 0.57 in early 2020 before rebounding as stimulus programs kicked in.

Each fluctuation tells a story. Strong AUD usually indicates robust commodity demand, especially from Asian partners like China and India. Weak AUD often suggests domestic economic stress or falling export values. Conversely, a strong USD can reflect US economic strength or global demand for safe-haven assets.

The USD to AUD pair is considered a “commodity currency” pairing due to Australia’s reliance on resource exports. This makes it highly sensitive to price changes in metals, energy, and agricultural goods.

Interestingly, over the past 20 years, the pair has averaged near 1.35, with long-term trends showing cycles tied to global economic phases—boom, bust, recovery. Understanding these historical movements offers context for current decisions and future forecasting.

Economic Factors Affecting USD to AUD

A wide range of macroeconomic elements drive the USD to AUD conversion. These include interest rate differentials, inflation rates, GDP growth, and employment statistics in both the US and Australia.

Interest Rates: The Federal Reserve and the Reserve Bank of Australia (RBA) both use interest rates to control inflation and stimulate growth. Generally, higher interest rates in a country attract more foreign investment, increasing demand for its currency. In 2025, the Fed maintains a benchmark rate of 4.75% while the RBA has recently increased rates to 4.10% to curb inflation.

Inflation: Inflation reduces purchasing power. Lower inflation in the US compared to Australia may support a stronger USD relative to the AUD. In contrast, if Australia manages inflation better, AUD can strengthen.

GDP Growth: In 2024, the US economy grew by 2.3%, while Australia posted a slower 1.7% increase. Slower growth in Australia may contribute to a weaker AUD, especially if coupled with declining exports or lower commodity demand.

Employment Figures: Strong job creation in either country usually boosts investor confidence. As of this year, the US unemployment rate is at 3.6%, while Australia hovers near 4.1%. A stronger labor market generally equates to higher consumer spending and economic momentum, affecting exchange rates.

Understanding these foundational forces allows traders and businesses to forecast likely currency movements. For example, if US interest rates are expected to drop, the USD might weaken against the AUD, prompting timely exchanges or strategic investments.

Impact of Global Events on Exchange Rates

Currency markets are not just numbers and charts—they’re reactions to real-world events. Over the past few years, global disruptions have created significant shifts in the dolar americano a dolar australiano exchange rate.

Pandemic Fallout: In early 2020, panic led investors to flock to the USD, seen as a safe haven, while risk-sensitive currencies like the AUD tumbled. But as recovery took hold and Australia’s economy reopened quicker than many others, AUD gained ground.

Geopolitical Tensions: Ongoing conflicts such as the US-China trade war or rising tensions in the Indo-Pacific influence investor risk appetite. Since AUD is closely tied to Asia-Pacific trade, these events directly affect its value.

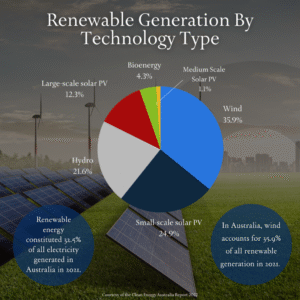

Climate Change Policies: Australia’s commitment to reducing carbon emissions and transitioning to renewable energy has made headlines. Major green investments—especially in hydrogen and solar—could strengthen the AUD by attracting global capital.

US Political Landscape: Presidential elections, debt ceiling debates, or changes in fiscal spending all impact how the world perceives the strength of the USD. For example, large deficits or controversial policy decisions can cause temporary depreciation.

In summary, watching global news isn’t just for staying informed—it’s essential for predicting currency trends. Traders and businesses who act early based on geopolitical cues often gain the upper hand.